Contact Us

Whether you're an investor, investee or a part of a leadership team seeking to increase value creation, our strategic consultants are on hand to guide you through your leadership journey. Contact us today.

March 22nd, 2024

Leadership change can be transformational for PE-backed businesses. But, on the converse, making too much change, too quickly can be detrimental, if not disastrous for value creation. Our research shows that every business has a ‘finite capacity for change’, however, investors and leadership teams can stretch their capacity, by strategically timing and sequencing new hires.

Decisive, proactive leadership change is a marker of top-performing businesses. Our recent report, Leadership Capital 2023, found that upper quartile performers make more change and make change sooner; on average 30 months earlier in the hold period than the worst performers.

But how much leadership change is too much? Leadership change is a double-edged sword. It can be transformational, but also disruptive. There is reward, but also risk. Will new hires deliver and how quickly? Will they gel with their leadership colleagues and engage their team effectively? Change takes time, communication, and effort, and if done badly, can slow the momentum of an organisation.

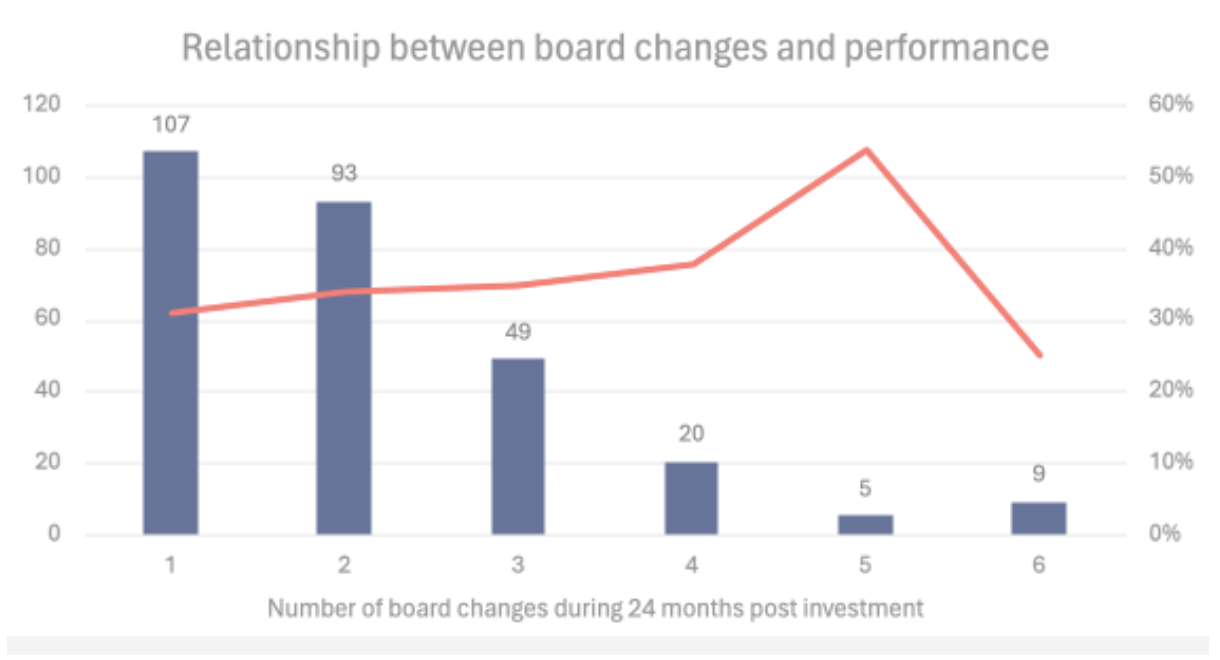

Through our research, we have identified a ‘capacity for change’ of five leadership roles within 24 months, with financial performance accelerating up to five changes, but experiencing a material decline thereafter. Understanding this capacity helps businesses to view change as capital that they can invest to drive returns, but which can also run out, putting a business under pressure.

Capacity for change is a consistent pattern we see across all types of PE-backed businesses, of all sectors and sizes. But critically, it isn’t set in stone. We’ve found that a business can increase its capacity for change in some situations by being smart with its leadership strategy, thereby avoiding any negative consequences.

Getting the timing right

Timing is everything for successful leadership change and we find that capacity for change is at its height following a capital event or M&A deal. At this point, existing leaders and the wider business are in the right mindset and more receptive to change, seeing themselves as active participants, rather than passive observers who lack control and ownership. Investors and management teams should therefore aim to maximise this window by acting decisively to optimise the leadership team following a deal.

This is what we see with top-performing businesses, the majority of whom make key leadership decisions within the first two years of the hold period, in contrast to worse performers who consistently delay decisions. What we’re seeing is the best investors being proactive rather than reactive by using data analytics to assess a leadership team at arm’s length ahead of a deal, so they can start building a change strategy e as early as possible, maximising the window for change.

Strategic sequencing

A company’s ability to absorb change can also be enhanced by optimising the sequence in which it happens. For example, changing the CEO first provides clarity of leadership, stability, and strategic direction, increasing receptiveness to further change. In upper quartile businesses, 84% of new CEOs made at least one SLT change within a year, and 39% made more, compared to just 50% and 31% of lower quartile businesses. The best CEOs are facilitators of further positive change, and they bring the organisation with them.

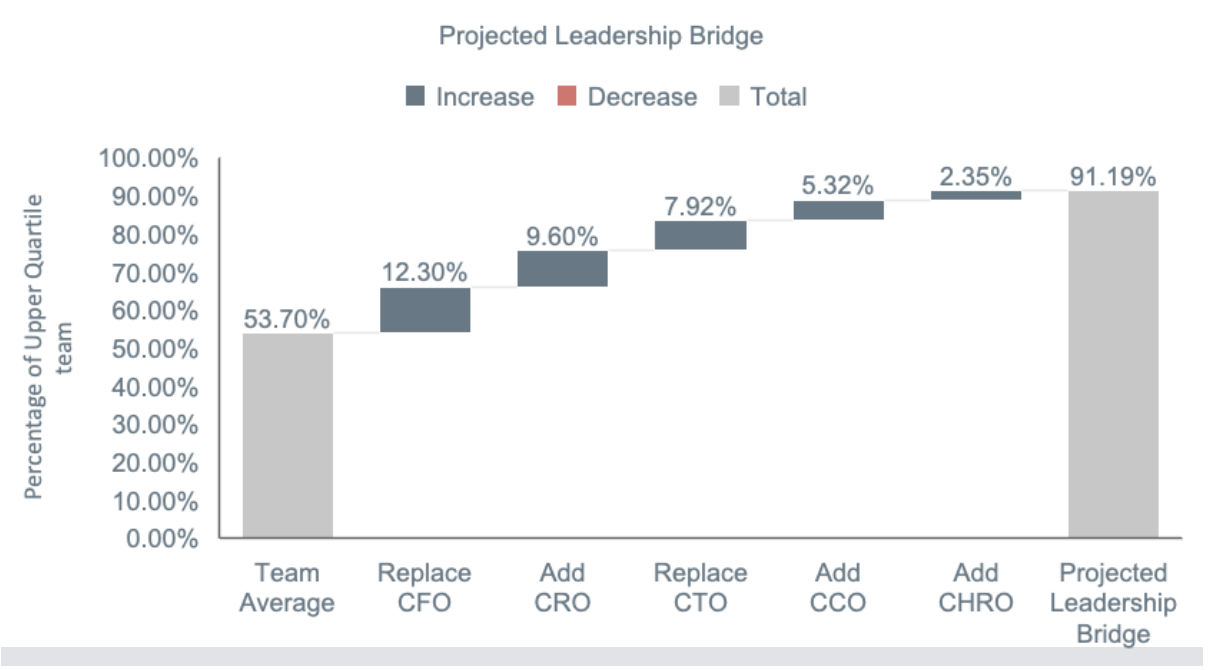

When looking at the sequencing of other leadership roles, the picture is usually more complex. No two businesses are the same, so there is no optimal sequence of leadership change that works across all businesses. It’s critical to look at each case individually based on the competencies and balance of the current team, immediate challenges and priorities, along with the demands of the value creation plan.

The challenge is always to maximise the upside while minimising the risk, ensuring the leadership strategy simultaneously supports the current team and business, while laying the groundwork for long-term objectives. It’s like a game of chess; how can you best arrange your pieces and make a sequence of moves to balance defence and attack?

We regularly work with companies where several leadership changes need to happen in relatively quick succession, using our Leadership Bridge tool to devise the optimal timing and sequence. By analysing the current team against the value creation plan, Leadership Bridge recommends not only the most impactful changes - benchmarked against high-performing teams - but also sequences the roadmap for change, to avoid disrupting growth while setting up the team with the right experience and competencies.

Maximising a finite resource

Understanding capacity for change helps create a mindset shift relating to leadership optimisation, the importance of looking ahead, and carefully considering priorities and timing. While investors and management teams are often in a hurry to bring in new leaders, and deal with team challenges and gaps as quickly as possible, it is a reminder that change is a finite resource. So, don’t waste it.

Whether you're an investor, investee or a part of a leadership team seeking to increase value creation, our strategic consultants are on hand to guide you through your leadership journey. Contact us today.