Contact Us

Whether you're an investor, investee or a part of a leadership team seeking to increase value creation, our strategic consultants are on hand to guide you through your leadership journey. Contact us today.

July 17th, 2024

Challenging times continue for mid-market investors, as interest rates remain high. The rising cost of debt is putting the buffers on investment, exits are being delayed amid falling valuations, plus consumer and business spending are being reined in. All these factors mean performance is behind where it should be, and funds are digging deep and exploring all the levers at their disposal to breathe new life into their portfolios.

As organic growth moves up the agenda, effective leadership has become even more critical, and, with core management teams established, investors are looking for an extra gear. That has led many to lean on the chair to take a more hands-on role and driven increased demand for executive chair hires. Could this be the secret weapon that investors are looking for?

While there are exceptions, historically, private equity-backed companies have tended to opt for a non-executive chair role, primarily focused on oversight and board leadership. Bringing a diverse array of experiences and perspectives garnered from positions held across industries, the purview of a non-exec chair extends beyond the minutiae of daily operations, focusing instead on sculpting the overarching strategic framework that underpins an organisation's trajectory.

In contrast, executive chairs are characterised by a fusion of seasoned expertise and hands-on involvement working in partnership with the CEO and management team to deliver the value creation plan, drive growth, and scale the business. Bringing a wealth of domain-specific knowledge to the table, they spend time digging into the organisational design, ensuring that the right team is in place, and pushing for tough decisions to achieve the desired outcome in a tight timeframe. They also liaise closely with investors and act as an important buffer with the management team, helping to aid communication and understanding between the two.

Executive chairs are invariably recent executives, often first-time chairs, with the C-suite mindset and fresh experience of the executive pressure cooker, combined with experience in navigating choppy waters. Naturally, the role also demands more time, up to three days per week, allowing for fewer portfolio roles, but the capacity for heavy lifting. Consequently, investors are also prepared to pay two to three times the salary of a more traditional non-exec chair.

It’s understandable and commendable that investors are exploring new avenues to growth in the current market, and executive chairs can be hugely valuable when leveraged in the right way. Nonetheless, it’s important to bear in mind that the executive chair won’t always be the right solution and should be approached with caution.

As with any leadership hire, it’s critical to look at the leadership team as a whole and ensure that an executive chair aligns with the needs of the board and the business. For example, if the current team is highly experienced, bringing in an executive chair who is fresh from the C-suite could result in clashes and disruption. Or, if the current leadership team is brilliant, and aligned with the plan, but performance issues are purely down to circumstance, an executive chair could potentially veer them off course.

Funds must also consider whether these individuals will stay for the long term, or simply provide a short-term boost, before being replaced by a more traditional non-exec chair as business needs evolve. Either way, investors must look at the full picture and all the possible consequences before making a critical hire, including how it may impact succession planning, to avoid any unintended consequences.

This is where leadership analytics can be so valuable, in breaking down the functional, situational, domain, and behavioural competencies of the current leadership team, how these align with the value creation plan, current situational challenges, and where the gaps and potential clashes are.

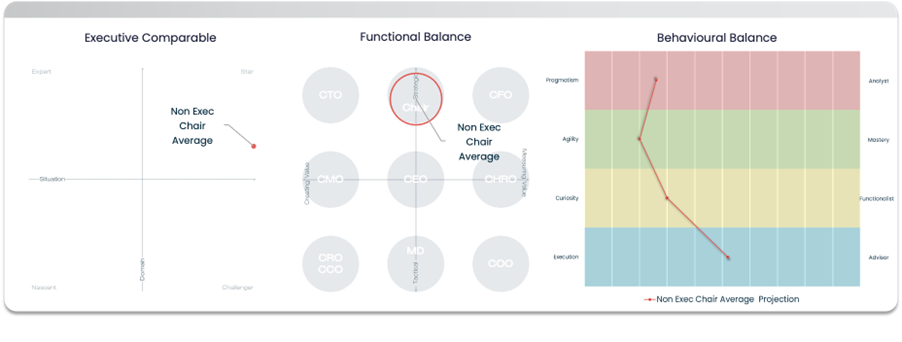

Our analysis shows that archetypical non-executive chairs demonstrate distinct strategic acumen, often prioritising situational expertise over domain-specific knowledge. They complement this with a focus on high agility and a capacity for effective delegation, enabling them to navigate diverse professional environments proficiently.

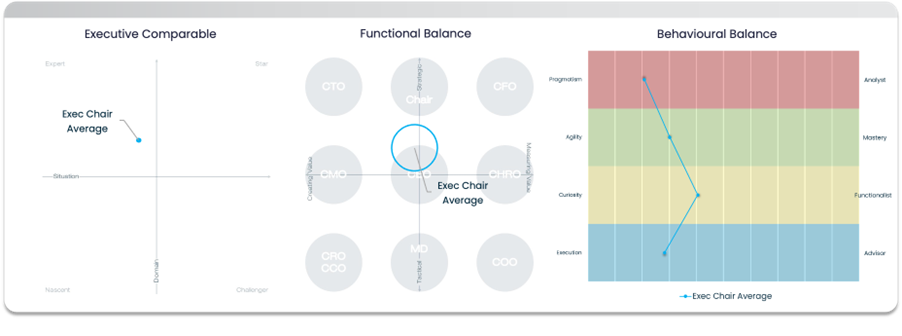

In contrast, executive chairs typically possess a greater depth of experience in tactical roles, placing them closer to the CEO archetype in terms of functional balance. This is supplemented by a behavioural mix focused on execution and pragmatism, with lower agility and curiosity than the non-executive chair archetype.

In contrast, executive chairs typically possess a greater depth of experience in tactical roles, placing them closer to the CEO archetype in terms of functional balance. This is supplemented by a behavioural mix focused on execution and pragmatism, with lower agility and curiosity than the non-executive chair archetype.

Ultimately, executive chairs and non-executive chairs stand as pillars of direction, each offering distinct yet complementary contributions to the private equity landscape. While the former imbues operations with seasoned expertise and tactical finesse, the latter provides strategic direction and prudent oversight. The key, however, is to focus less on definitions and more on identifying the right chair for the right leadership team and business - particularly in the current climate.

Ultimately, executive chairs and non-executive chairs stand as pillars of direction, each offering distinct yet complementary contributions to the private equity landscape. While the former imbues operations with seasoned expertise and tactical finesse, the latter provides strategic direction and prudent oversight. The key, however, is to focus less on definitions and more on identifying the right chair for the right leadership team and business - particularly in the current climate.

Enduring slower periods is part of being a successful investor but there are signs that this current slump is nearing an end. Of the chairs I’ve spoken to recently, the majority believe that the market is picking up, and they are currently looking at more IMs than in the last 12 months. Meanwhile, our corporate finance friends anticipate an uptick in deal conversion in June and a shift in the environment by the end of the year.

Of course, nothing is certain, and it’s always wise to build optionality. But when it comes to leadership hires, as with any other area of business, investors must be sure key decisions are backed up by data, to avoid any unnecessary hiccups on the road back to growth.

If you would like to discuss the role an executive chair could play in your private equity business, get in touch with Ruby at ruby.sheera@thelcapgroup.com

Whether you're an investor, investee or a part of a leadership team seeking to increase value creation, our strategic consultants are on hand to guide you through your leadership journey. Contact us today.