Contact Us

Whether you're an investor, investee or a part of a leadership team seeking to increase value creation, our strategic consultants are on hand to guide you through your leadership journey. Contact us today.

February 13th, 2025

As technology has become increasingly complex and integral to business success, the risk of investing in technical businesses – particularly for a generalist investor - has increased. Without deep technical expertise, investors may not fully understand what they’re buying, how it works, or how future-proof or scalable it will be. The speed at which technologies have evolved and the sheer breadth of what’s available makes technical due diligence more challenging, but even more important.

We spoke to Kassir Kayani, a Chief Technology Officer with over 28 years of experience, about how investors can avoid ‘tech buyer’s remorse’ or identify hidden gems, particularly given current market headwinds.

About Kassir Kayani

Currently an independent consultant to private equity, Kassir’s background spans corporates, startups, and PE-backed businesses. Most recently, he was CPTO at Sponge Learning, backed by Aliter Capital, and before that, he worked alongside Norland Cap, ICONIQ Cap, and RIT as CTO at CSL group, seeing it through to exit to ECI. He began his career in telecoms as an engineer at Orange, and later held roles at 3, O2, and Sky, before co-founding Hive, an innovative smart home venture. Over the years, he has gained a deep insight into the vital role of technical due diligence, and the risks of getting it wrong.

Why is technical due diligence more important than ever?

In the past 10 to 20 years the role of technology in business has grown exponentially, and sophisticated platforms that were once the preserve of big corporations have become widely accessible. Now, companies of almost any size can leverage technology, bringing huge growth opportunities for private equity and venture capital investors. However, understanding technology's commercial and strategic advantages (or disadvantages) demands a deeper due diligence approach that goes beyond assessing for risks.

Another factor is the recent fall in valuations and exits, accompanied by rising interest rates, which have made value creation harder, and led to a greater emphasis on margin improvement and organic growth. Technology is a fantastic catalyst for value creation through both innovation and efficiency, but how well it achieves those objectives depends on how it’s designed, deployed, and managed. Its ability to adapt efficiently and quickly to deliver what is required is what due diligence must investigate.

What should technical due diligence cover? Are there elements that investors and their auditors often overlook?

For a company that sells technology products, or couldn't function without technology, a comprehensive due diligence process should scrutinise the 3Ps of technology (Platforms, Processes, People), and within that, both critical risks and future potential.

When it comes to critical risks, due diligence auditors are generally pretty astute at identifying potential issues, for example, compliance with regulations such as GPDR and the UK's DPA Act 2018. They're also pretty good at assessing security (accreditations such as Cyber Essentials Plus, IS27001, or SOC2 help), or indeed things that just don’t feel ‘right’ because of their many years of experience.

However, assessing future potential is much harder, demanding time which auditors rarely have. Consequently, it often gets overlooked or rushed, even though it plays a critical role in achieving an accurate valuation and is a strong indicator of how effectively commercial objectives can be met well into the future.

What is involved in assessing future potential?

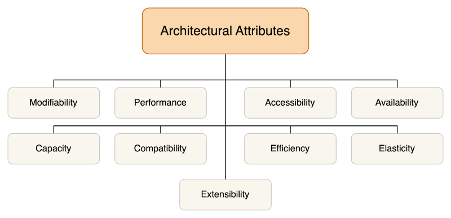

This is where architectural attributes such as modifiability, performance, and capacity play an important role, as they directly impact the speed, cost, and time to make important business changes. These attributes, and their impact on a company's products, services, and operations, aren’t talked about enough, even though they have a significant impact.

Imagine two companies at a point in time with identical products and the same number of customers. They look the same from the outside, but if one platform has better attributes, it can react more quickly to threats, or maximise opportunities such as adding new features, launching new products, or entering new geographies. While some standards, such as ISO 25010, try to address this problem, they've had limited impact, and the lack of industry benchmarks makes it challenging to quantify how good the technology is and make comparisons between companies.

A fund can enhance due diligence by understanding the link between business outcomes and architecture attributes. A good first step is defining the target business outcomes and asking how much time, effort and cost it will require to achieve this. Example questions include:

Starting with the 12-36 month roadmap, what’s the scope and frequency of changes required in products and business activities that rely heavily on technology? How does it compare to the previous 12-24 months?

Where is capacity needed and in what timeframe? Is it easy to scale, or are there constraints? What will it cost?

How much of the internal capacity is used to just operate and maintain systems, and what’s left to make other changes or enhancements?

How easily can the platforms accommodate different customer requirements without changing the code base? Can these requirements be delivered via configuration without developer involvement?

Are investments required to fix poor attributes, and will this delay something else?

In the pressure of a deal environment, an ideal due diligence process might not be possible. How can investors balance speed and depth while minimising disruption for the target?

In reality, speed and depth are both critical for success, and striking the right balance isn’t easy. Context is important and if multiple investors are competing for the same company, concluding a deal quickly is important. The following questions may help strike the right balance of speed and depth, along with the risks of moving too quickly:

How competitive is the sector? If there are a lot of competitors and frequent product enhancements, or the underlying technology is evolving quickly, a more thorough assessment is advisable.

Is the technology, and how it is applied, mature and well understood? If so, a less thorough assessment is ok.

What role does technology play in critical business functions and how significant is that commercially? Clarity on these factors will help steer the technical assessors on where to look and how deeply.

Having a broad network of technical advisors and experts who understand the range of technologies you may encounter, and you can call upon quickly, will deliver a faster and more robust assessment. This is particularly true for newer technologies such as AI and Large-Language-Models (LLM) where fewer experts are available.

Investors can also save time and lessen the need for in-depth technology audits by reviewing the historical performance of product and technology teams in delivering important business outcomes. For example, customer satisfaction scores, the breadth of use cases, the frequency of new feature releases, and the time and effort they took are important indicators of how good the technology is.

Why is the CFO-CTO relationship critical when carrying out leadership diligence of a technology business?

The CTO-CFO relationship is always more important in a tech company because technology plays a bigger role and accounts for a larger proportion of spend. When there's a push to cut costs or achieve more for less, as in the current climate, healthy tension in this relationship can quickly become unhealthy, so strong relationships are vital.

Assessment of CTO and CFO competencies as part of due diligence ensures that both sides have the experience and behaviours to make the relationship work. CFOs must have a good grounding in technology and products or at least a genuine desire to learn. Conversely, a CTO must recognise the importance of helping the CFO to understand all the options and not just presenting the ones the technology team thinks are “acceptable”. A CTO is a business leader, not just a technology leader, and where there’s a conflict, remember technology is there to serve the business, not the other way around.

Leadership assessment tools can help evaluate CTO and CFO competencies and complementarity of behaviours, to ensure leaders can work constructively together for the duration of the hold period. This provides valuable assurance as part of due diligence and hiring processes, particularly when time is of the essence.

At LCap we specialise in developing high-performing leadership teams. Both DRAX and DRAX Affinity include industry and functional specialists across Software/Technology sectors and Technology functions, globally in Private Equity. Our proprietary frameworks, like Leadership Dynamics, empower organisations to evaluate leadership, assess technical capabilities, and align these with their commercial objectives with our behavioural assessment, PACE, enabling and fostering high performance. Whether you’re navigating a tech acquisition or optimising your leadership team to drive growth, we’re here to help you turn challenges into opportunities.

Let’s start a conversation.

Reach out today to discover how DRAX and DRAX Affinity can provide the strategic guidance, leadership expertise, and tools you need to achieve long-term success in today’s fast-changing market. Together, we’ll chart a path to sustainable growth and enduring value.

Whether you're an investor, investee or a part of a leadership team seeking to increase value creation, our strategic consultants are on hand to guide you through your leadership journey. Contact us today.